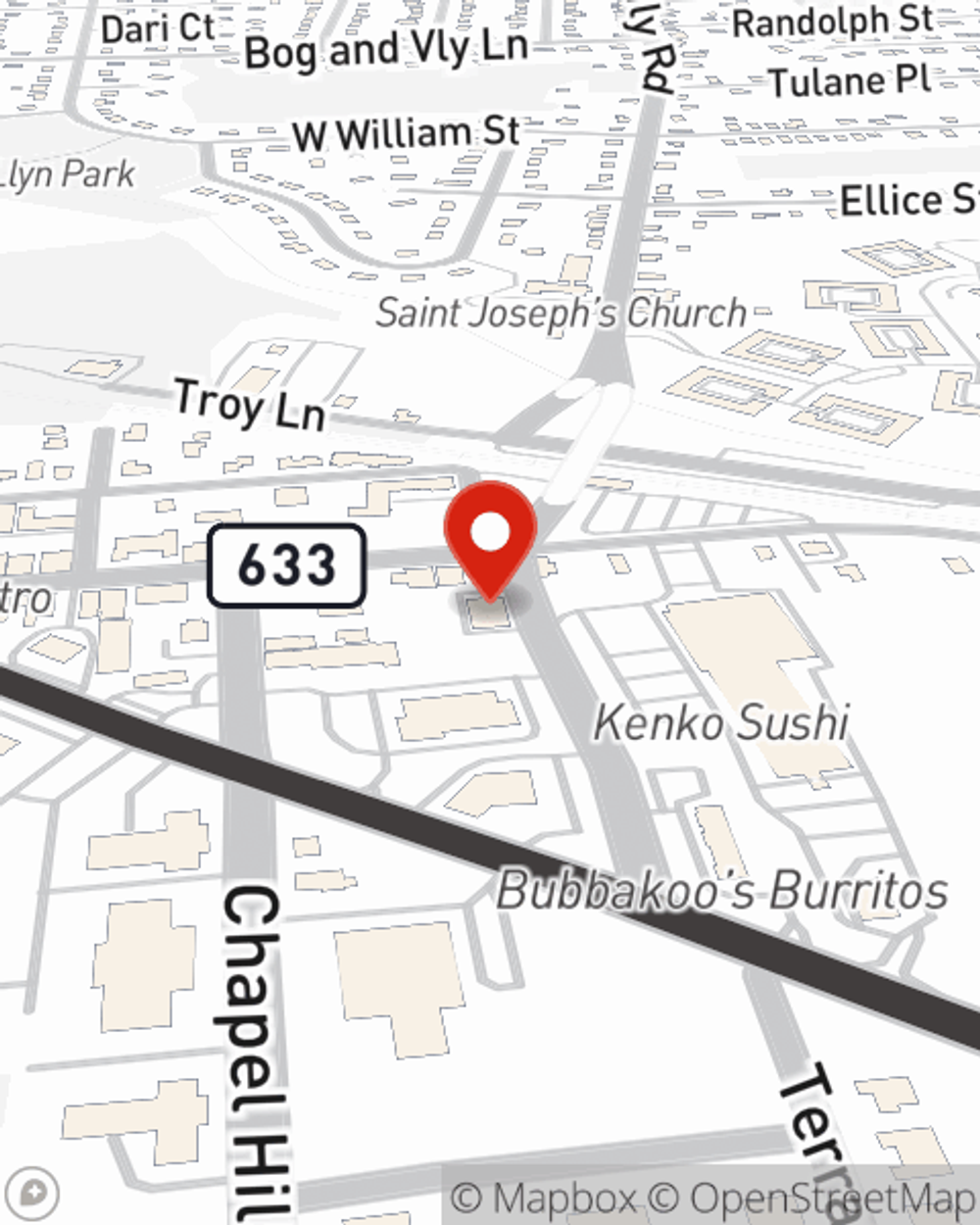

Business Insurance in and around Lincoln Park

One of Lincoln Park’s top choices for small business insurance.

Cover all the bases for your small business

- Pequannock

- boonton

- wayne

- staten island, NY

- brooklyn, NY

- riverdale

- little falls

- butler

- kinnelon

- totowa

- towaco

- montville

- fairfield

- west caldwell

- jefferson

Insure The Business You've Built.

You may be feeling overwhelmed with running your small business and that you have to handle it all on your own. State Farm agent Diana Mati, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you customize a policy that's right for your needs.

One of Lincoln Park’s top choices for small business insurance.

Cover all the bases for your small business

Surprisingly Great Insurance

Whether you are a fence contractor a real estate agent, or you own a bridal shop, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Diana Mati can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and buildings you own.

Reach out to the outstanding team at agent Diana Mati's office to help determine the options that may be right for you and your small business.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Diana Mati

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.